Bancor’s Arbitrage Framework Integrates Garbled Circuits on COTI

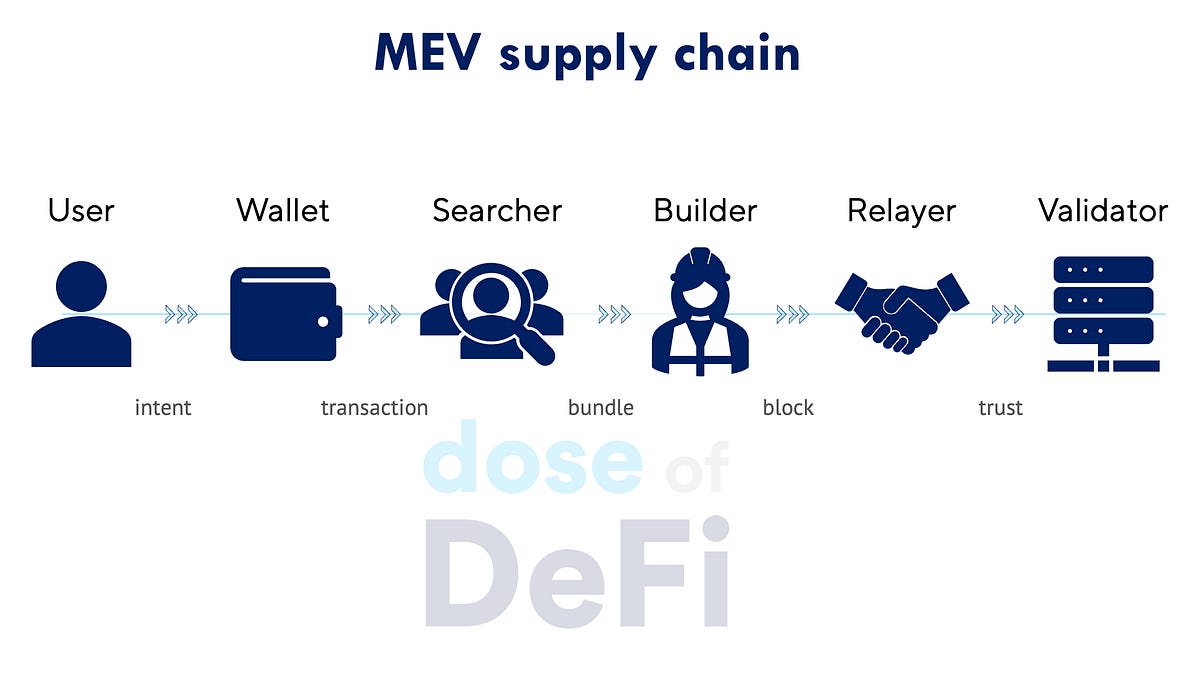

Arbitrage is one of the most competitive activities onchain.

Opportunities appear briefly, execution windows are tight, and the moment a transaction is broadcast, it becomes visible to everyone watching. In that environment, how arbitrage is executed matters just as much as whether an opportunity exists.

With the integration of COTI’s Garbled Circuits into the Arb Fast Lane, Bancor introduces a meaningful upgrade to onchain arbitrage execution: privacy applied intentionally, at the exact point where transparency becomes a liability.

What the Arb Fast Lane does

The Arb Fast Lane is Bancor’s onchain arbitrage trading bot and execution system.

It continuously monitors markets, searching for price discrepancies across all major decentralized exchanges on a blockchain. When it identifies an opportunity, it computes a route — a sequence of trades across one or more liquidity sources — designed to capture that discrepancy.

Once a route is identified, the Arb Fast Lane executes the arbitrage onchain, with each trade including explicit conditions defined in advance. The route is executed step by step, and if the final result does not meet the predefined threshold, the transaction reverts.

This structure ensures that arbitrage execution is disciplined and deterministic:

- opportunities are identified continuously

- routes are computed programmatically

- execution only settles when conditions are met

Where transparency becomes a problem

On transparent blockchains, transaction inputs are readable before execution.

In arbitrage, one input is especially revealing: the minimum acceptable outcome.

That value does more than protect against bad execution. It communicates economic intent. For anyone monitoring the mempool, it provides a clear signal about which transactions are expected to be profitable — and therefore worth targeting.

This is one of the ways arbitrage transactions are copied or front-run.

A competing searcher can observe the transaction, infer its expected profitability from the minimum outcome of each arbitrage trade, and submit a competing transaction.

This dynamic makes arbitrage environments adversarial. Searchers invest heavily in infrastructure, data collection, and route discovery, only for that work to be exposed at the moment of broadcast through readable execution parameters.

In many cases, competitors don’t need to understand the full route. They only need to know how attractive it is.

“On some chains, if we didn’t use a privacy RPC — Ethereum is a good example — every single trade would be copied. No exceptions. It’s a serious problem.

Privacy-oriented blockchains change that dynamic. Arbitrage searchers can produce transactions based on their own data and research, without having that work immediately stolen by bots that are simply reading transaction data.

If someone else finds the opportunity first, that’s fair competition. What isn’t fair is losing the trade because the work was exposed at the moment of broadcast.”

— Tiago, Bancor/Arb Fast Lane Research

Privacy-oriented blockchains like COTI change the equation by encrypting sensitive execution inputs at the protocol level, shifting arbitrage back toward discovery and execution.

https://medium.com/media/ab4c0f839556c6cae2f9f91ce944d1df/href

What COTI’s Garbled Circuits enable

Garbled Circuits, as implemented by COTI, allow specific transaction inputs to be obfuscated while still being used during smart contract execution.

Rather than making an entire transaction private, Garbled Circuits enable selective input encryption:

- a sensitive value is encrypted before broadcast

- the contract expects the encrypted value that is then decrypted only during execution

- the contract can still enforce the condition

- the value is never exposed in plaintext to the broader network

What changes in the Arb Fast Lane

With Garbled Circuits integrated into the Arb Fast Lane, the minimum acceptable outcome for a route is encrypted.

The logic does not change:

- the minimum threshold still exists

- it is still enforced during execution

- if the threshold is not met, the transaction still reverts

What changes is who can see that threshold before execution.

The route may still be observable. The execution remains onchain. The outcome is still verifiable.

But the parameter that broadcasts profitability is no longer readable in plaintext.

COTI’s Garbled Circuits remove the economic incentive for this kind of behavior. Arbitrage shifts back toward competing on discovery and execution — not exploiting readable transaction inputs.

Why this matters for arbitrage

Multiple searchers identifying the same opportunity, racing to execute, and winning on speed or efficiency is how arbitrage is supposed to work.

Less healthy dynamics emerge when value can be extracted by simply observing and copying execution parameters after the research and discovery work has already been done.

Encrypting the minimum acceptable outcome shifts competition back toward discovery and execution quality, rather than observation-based extraction.

It does not eliminate competition.

It makes competition fairer.

https://medium.com/media/e9cfb85937112def6c94221469b5440d/href

“Arbitrage really is a dark forest. There are many ways to gain an advantage, but one of the easiest is simply copying someone else’s trade and front-running it. In some cases, competitors will even copy calldata directly — it’s blatantly obvious when it happens.

By encrypting the minimum acceptable outcome, we stop broadcasting how profitable a trade is expected to be. That obscures profitability and makes it much harder to target and steal the largest or most attractive opportunities.”

— Tiago, Bancor/Arb Fast Lane Research

This selective approach is broadly useful across onchain systems, wherever transparency is desirable but specific inputs are operationally sensitive. In the context of the Arb Fast Lane, the sensitive input is clear — and that clarity is what makes selective encryption effective.

Trades still settle onchain.

Routes still execute publicly.

Results remain auditable.

Cost matters — and optimization is part of the roadmap

Onchain encryption and decryption introduce overhead.

In the current implementation, a meaningful portion of transaction gas is consumed by cryptographic operations. For arbitrage, where margins are often thin, execution cost directly determines which opportunities are viable.

COTI is actively working on improving encryption and decryption efficiency, including gas optimizations and moving parts of the process into chain precompiles. These improvements are critical for scaling protected execution without sacrificing economic viability.

Lower execution costs don’t just make existing trades cheaper.

They expand the range of arbitrage opportunities that can be executed profitably, allowing the Arb Fast Lane to act on tighter spreads and smaller price discrepancies — supporting stronger price parity across the chain.

Closing

Transparent systems still need boundaries.

Research, infrastructure, and execution quality require sustained capital, engineering effort, and constant iteration. Transparency shouldn’t undermine that work — and innovation only follows when it is rewarded.

Applying privacy intentionally at the execution layer helps restore that balance, aligning engineering efforts to focus on what’s important with regard to arbitrage — stabilizing markets rather than spending significant engineering time on the execution layer. It preserves openness where it adds value, while preventing transparency from turning profitability into an easy target.

The integration of COTI’s Garbled Circuits into the Arb Fast Lane reflects that principle in practice: a small change in mechanism with long-term implications — supporting healthy competition, increased development activity, and onchain market maturity.

Bancor

Bancor is a pioneer in decentralized finance (DeFi), established in 2016. It invented the core technologies underpinning the majority of today’s automated market makers (AMMs) and continues to develop the foundational infrastructure critical to DeFi’s success — focusing on enhanced liquidity mechanics and robust onchain market operation. All products of Bancor are governed by the Bancor DAO.

Website | Blog | X/Twitter | Analytics | YouTube | Governance

Carbon DeFi

Carbon DeFi, Bancor’s flagship DEX, enables users to do everything possible on a traditional AMM — and more. This includes custom onchain limit and range orders, with the ability to combine orders into automated buy low, sell high strategies. It is powered by Bancor’s latest patented technologies: Asymmetric Liquidity and Adjustable Bonding Curves.

Website | X/Twitter | Analytics | Telegram

The Arb Fast Lane

DeFi’s most advanced arbitrage infrastructure powered by Marginal Price Optimization, a new method of optimal routing with unmatched computational efficiency.

Website | Research | Analytics

Protecting Arbitrage Execution With Privacy, Without Sacrificing Onchain Transparency was originally published in Bancor on Medium, where people are continuing the conversation by highlighting and responding to this story.